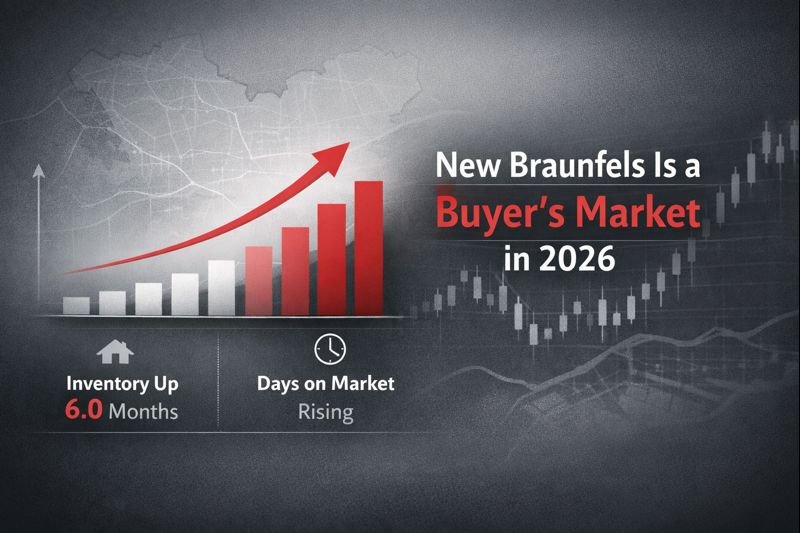

Should you buy a new construction home or an existing home in the New Braunfels area? Here’s the truth: the San Antonio–New Braunfels metro area hit a 6.1-month inventory back in August 2025. That means you, the buyer, have more choices than you’ve had in years. But don’t get excited just yet – median prices also crept up 1.8% year-over-year. So, the question isn’t just *if* you should buy, but *what* you should buy: new construction or resale?

I am Cody Posey, you New Braunfels and surrounding area Real Estate Expert.

The New Braunfels Buyer’s Dilemma: New vs. Used

I’m Cody Posey, and I’m not going to sugarcoat this. The New Braunfels, Canyon Lake, and Hill Country real estate markets are complex, and the choice between a brand-new home and a pre-owned one is a strategic decision, not an emotional one. We’re going to break down the pros and cons of each, using real numbers and Comal County data to help you make the right call. Forget the fluff; let’s get to work.

Your biggest pain point right now is likely uncertainty. You’re seeing the shiny allure of new construction with its modern features and builder incentives, but you’re also eyeing the potential of a resale, thinking you might snag a deal with the increased inventory. Let’s dismantle that uncertainty with facts.

New Construction: The Allure of the Untouched

New construction. It’s tempting. No one’s ever lived there, everything’s under warranty, and you get to pick your finishes (to a point). But let’s dig deeper than the surface.

Pros of New Construction:

- Modern Features: Energy-efficient appliances, smart home technology, open floor plans – these are standard in many new builds. Let’s be honest; that 1970s ranch house isn’t likely to have a dedicated charging station for your electric vehicle.

- Builder Incentives: Builders are often willing to offer incentives to move inventory, especially in a market with increased supply. This could include closing cost assistance, appliance packages, or upgrades. Don’t take these at face value, though; we’ll dissect them later.

- Warranties: New homes typically come with warranties covering everything from structural defects to appliance malfunctions. This can provide peace of mind, especially for first-time homebuyers.

- Customization (Sometimes): Depending on the builder and the stage of construction, you may have the opportunity to personalize certain aspects of the home, such as flooring, paint colors, and countertops.

Cons of New Construction:

- Higher Initial Price: New homes generally command a premium compared to resale homes. You’re paying for that “new” factor.

- Location, Location, Location: New developments are often located on the outskirts of town, meaning longer commutes and less access to established amenities. Think about that drive to HEB at 7 AM.

- Hidden Costs: Landscaping, window coverings, and other finishing touches are often not included in the base price of a new home. These costs can add up quickly.

- Construction Delays: Building a home can take time, and delays are common. Weather, material shortages, and labor issues can all push back your move-in date.

- HOA Fees: New developments often have homeowners associations, which come with monthly or annual fees. These fees can cover things like landscaping, community amenities, and security, but they also add to your overall cost of ownership.

The New Construction Deep Dive: Comparing Apples to Apples

Here’s where I separate myself from the pack. It’s not enough to just look at the sticker price. We need to analyze the total cost of ownership. Let’s take a hypothetical example in the Veramendi community in New Braunfels. A new construction home might be listed for $450,000 with a builder offering $10,000 in closing cost assistance. Sounds great, right?

But let’s factor in:

- Property Taxes: Newer homes often have higher property taxes due to the higher assessed value.

- HOA Fees: Veramendi has HOA fees. We need to factor that into the monthly equation.

- Landscaping: You’ll likely need to spend several thousand dollars on landscaping.

- Window Coverings: Builders often don’t include window coverings. Another unexpected expense.

Now, let’s look at resale homes.

Resale Homes: The Opportunity for Equity and Negotiation

Resale homes, or what some might call “used” homes (I prefer “pre-loved”), offer a different set of advantages and disadvantages.

Pros of Resale Homes:

- Lower Price Point (Potentially): Resale homes are often priced lower than new construction, especially in established neighborhoods. This can free up capital for other investments or allow you to buy a larger home.

- Established Neighborhoods: Resale homes are typically located in established neighborhoods with mature landscaping, existing amenities, and shorter commutes.

- Negotiation Leverage: With increased inventory, you may have more room to negotiate the price and terms of the sale.

- Immediate Move-In: No waiting for construction to be completed. You can move in as soon as the closing is finalized.

Cons of Resale Homes:

- Older Features: Resale homes may have outdated appliances, less energy-efficient systems, and floor plans that don’t align with modern lifestyles.

- Potential Repairs: Resale homes may require repairs or renovations, which can add to your overall cost of ownership.

- Competing Offers: Even with increased inventory, desirable resale homes in prime locations can still attract multiple offers.

The Resale Reality Check: Finding Value in Existing Homes

Let’s go back to our Veramendi example. You find a resale home, built in 2020, listed for $420,000. It needs some updating – new flooring in the living room and a fresh coat of paint throughout. But it’s got mature landscaping, a great location within the neighborhood (closer to the amenities), and no HOA initiation fee.

Here’s the breakdown:

- Price: $420,000 (negotiable, given the inventory)

- Repairs/Updates: Flooring ($5,000), Paint ($2,000) = $7,000

Even with the repairs, your initial investment is likely lower than the new construction option. More importantly, you’re buying into an established neighborhood, where home values are already appreciating. The key here is knowing how to negotiate and assess the true cost of repairs.

Comal County Data: Absorption Rates and Market Trends

I don’t rely on hunches; I rely on data. Comal County absorption rates (the rate at which homes are being sold) are crucial for understanding the market. If the absorption rate is slowing down, it means homes are staying on the market longer, giving you more leverage as a buyer. As of late 2025, we’re seeing a slight decrease in the absorption rate compared to the previous year, indicating a shift towards a more buyer-friendly market.

Specifically, let’s look at the 78132 zip code (New Braunfels). We can pull comps – comparable sales of similar homes – to see what properties are actually selling for, not just what they’re listed at. This will give you a realistic picture of the market value and your potential negotiation power.

Actionable Takeaways: Your Next Steps

- Get Pre-Approved: Know your budget. Don’t fall in love with a house you can’t afford. Talk to a lender and get pre-approved for a mortgage.

- Define Your Priorities: What’s more important to you – modern features or location? Lower initial price or minimal maintenance? Make a list of your must-haves and nice-to-haves.

- Research Neighborhoods: Drive around, talk to residents, and get a feel for the area. Consider factors like schools, crime rates, amenities, and commute times.

- Work with a Knowledgeable Agent: (That’s me.) I can provide you with access to market data, help you negotiate effectively, and guide you through the entire buying process. Don’t go it alone.

- Don’t Be Afraid to Walk Away: The market is shifting. Don’t feel pressured to buy a home that doesn’t meet your needs or fit your budget. There are plenty of other fish in the sea (or houses on the market).

- Factor in the long term: This is your biggest purchase, don’t treat it lightly.

The Bottom Line: It’s About the Numbers

Ultimately, the decision between new construction and resale homes in New Braunfels, Canyon Lake, and the Hill Country comes down to the numbers. You need to analyze the total cost of ownership, factor in your individual priorities, and be prepared to negotiate. Don’t let emotions cloud your judgment. This is a business decision, and you need to treat it as such.

And remember that *Homes for sale New Braunfels* fluctuate, inventory fluctuates, and deals fluctuate. Now is the time to get the real information.